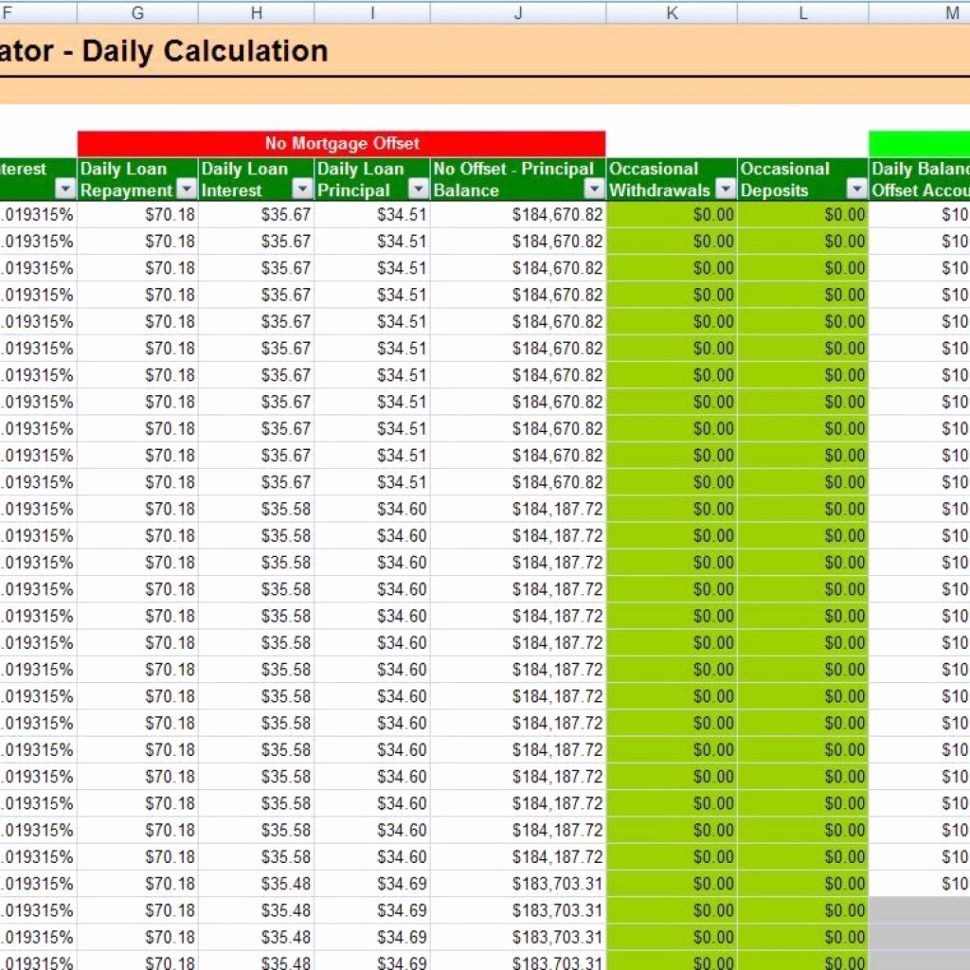

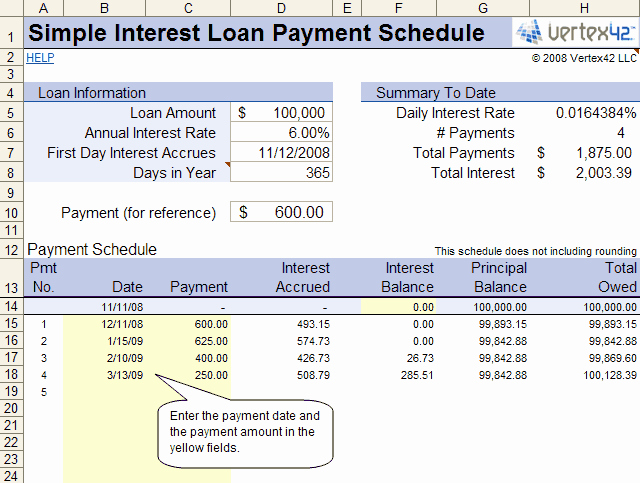

You will spend $65.47 on interest and $4,063.19 on principal. Loan amortization schedule for year 6 (2028): You will spend $266.32 on interest and $5,238.32 on principal. This amortization table Excel template will show you the balance remaining. It calculates the interest and principal payments for a given loan amount within a set timeframe. Loan amortization schedule for year 5 (2027): This all-purpose Microsoft Excel amortization schedule template can be used for a variety of loan types including personal loans, mortgages, business loans, and auto loans.

You will spend $463.83 on interest and $5,040.81 on principal. Loan amortization schedule for year 4 (2026): You will spend $653.93 on interest and $4,850.71 on principal. Loan amortization schedule for year 3 (2025): You will spend $836.85 on interest and $4,667.79 on principal. Loan amortization schedule for year 2 (2024):

You will spend $236.98 on interest and $1,139.18 on principal. Loan amortization schedule for year 1 (2023): Print this amortization schedule on paper! period: Please note that if you are calculating a mortgage loan, property taxes, property insurance and private mortgage insurance is neglected in the calculation, they will increase the amount of your regular periodic payments. As you can see, initially a larger amount is applied towards interest and as the loan matures the portion applied towards the outstanding principal balance gets larger and larger. One portion is put towards interest ( interest paid), while the other portion goes towards principal ( principal paid). The loan amortization table below shows your monthly payment divided into two portions. This amount should be paid to the lender, bank or lending institution for 5 years. The monthly payment for a $25,000.00 loan at 3.85% anual interest rate will be $458.72 per payment. Scroll down to view the loan summary table. Comma can be used for digit grouping symbol and the decimal symbol must be a dot. Do not use currency and percentage signs in the input fields. To calculate the amount of the regular periodic loan payments and to generate automatically a loan schedule, the following values are required: loan amount, interest rate, loan length and payment frequency. Amortization Schedule generated by the website.

0 kommentar(er)

0 kommentar(er)